News from customs and foreign trade

11. December 2024 ·

4 Min. Reading time

ICS2 – Data requirements 2023

Dear customs community,

As I have received a lot of follow-up questions after my post on ICS2 here on LinkedIn, I would like to dedicate this newsletter to ICS2 once again and provide you with some more background information.

In this article, I would primarily like to discuss how the ICS2 initiative will affect both logistics companies and importers, what deadlines need to be observed for implementation and what data/information will need to be provided in the future. Above all, however, I would like to provide specific answers to the questions I have been asked:

What is the purpose of the EU Commission's ICS2 initiative?

ICS2 was developed to more reliably protect the European single market and its citizens from threats, while facilitating "legitimate trade".

As is well known, ICS2 is a new IT system whose functionality is essentially based on analysing security-relevant data at the earliest possible stage to enable the customs authorities to intervene at the right time and in the right place. The modern architecture should also help to facilitate the exchange of information between economic operators and EU customs authorities.

The introduction of ICS2 will be completed in three phases. What changes do we need to be prepared for? What deadlines need to be observed?

Each phase of ICS2 affects different economic operators and modes of transport, with the first phase having already entered into force on 1 March 2021. Economic operators must declare their goods to ICS2 depending on the type of services they provide.

The first phase concerns express and postal services in air transport (before loading) and came into force on 15 March 2021.

The second phase affects all air freight as well as express and postal services (in full) and comes into force on 1 March 2023.

Phase 3 will come into force on 1 March 2024 and will then also affect the sea route as well as road and rail.

For many companies, especially importers, this phase has passed by almost silently. Why is that?

The main reasons for this are likely to be as follows:

Firstly, the first phase only implemented measures relating to the period before loading. Controls or other measures are therefore generally still implemented in the third country. As a rule, the importer will not be aware of this.

Phase 1 also initially affects express and postal services - in other words, from the importer's perspective, external service providers who handle the registration.

As there are also no interfaces to national systems such as the ATLAS IT procedure (e.g. no registration as a preliminary document), there are no points of contact here either.

The two pieces of information in particular, the consignee's EORI number and HS code, are not usually available to the carrier. How can it be ensured in practice that the information is available at the right time so that there are no delays in the supply chain?

In fact, the required data elements themselves have not changed much. What is new, however, is the time sequence and the relevant requirements. After all, with ICS2, certain data must be available before loading and transmitted in corresponding declarations. This is precisely where the additional complexity comes from.

Smooth and delay-free processing will therefore require efficient processes more than ever. For some companies, the key could also lie in what is known as "multiple filing". Different parties in the supply chain can complete the application, but must of course reference each other seamlessly.

As a general rule, of course, the EORI number can usually only be provided by the consignee. However, the 6-digit HS code should also regularly be provided by the exporter. After all, the exporter knows the technical specifications of the goods best.

Who is legally responsible for the accuracy of the data?

The person who submits the application is initially responsible - but in fact anyone else who has provided information is also responsible.

What measures should our readers take to ensure that the introduction of ICS2 goes smoothly?

Firstly, it is necessary to build up the necessary expertise about ICS2 and to fully understand the relevant requirements and innovations. Furthermore, IT systems and processes should be reviewed with regard to the new requirements and adapted if necessary. It will also be essential to check the interfaces to the relevant other parties in the supply chain and, if necessary, to set up the additional exchange of information.

Dear readers, have you already prepared for the introduction of ICS2? How are you dealing with the challenges? I look forward to your comments and a constructive dialogue with you!

Read more

11. December 2024 ·

2 Min. Reading time

Advantages of the simplified customs declaration

A member of my network has asked me to explain the advantages of the simplified customs declaration. I would like to answer this question today as best I can in a short post like this. ✅

A standard customs declaration must contain all the data and information required for placing the goods under the relevant customs procedure. In addition, all documents must also be submitted at the time the goods are presented.

There are essentially two types of information and documents:

1️⃣ Concerning the nature of the goods -> Keyword: Prohibitions and restrictions on imports

2️⃣ required for the calculation of import duties -> Keyword: Duty collection

The simplified customs declaration now divides the customs declaration into precisely these two sections, so to speak.

The information relating to the goods is required in the initial declaration, which is submitted with the presentation of the goods. Documents that also relate to the characteristics of the goods (e.g. phytosanitary certificate) or that are required for a customs inspection must also be submitted at this time.

However, details and documents relating to the collection of import duties, such as the commercial invoice, proof of preference, etc., can be submitted at a later date (usually 10 days) in the so-called supplementary customs declaration (SCD). If these documents and information are regularly not available at the time of import, delays in customs clearance can be avoided by using this simplification.

If you make a large number of imports, the ECC can also be summarised, for example for all imports made within a calendar month. This means that even longer deadlines can be used and all import duties for a month can be summarised in a single payment. This optimises internal processes and reduces costs.

Do you already use the simplified customs declaration? I look forward to your comments!

Read more

11. December 2024 ·

1 Min. Reading time

WEBINAR: Handling DDP correctly

Attention - limited places - First Come - First Serve!

Dear customs experts,As announced in our live interview "DDP - a delivery condition with pitfalls!", the two experts Matthias Kern and Jan Olaf Leisner are still available to support us in the correct handling of this complex delivery condition in terms of customs and tax law. The speakers will be available to answer your questions in a 90-minute webinar on three dates. You can register for your preferred date via the following link.https://www.pasani-academy.de/zoll-kurse/logistik-webinar-ddp-sendungen/

But don't wait too long, the number of participants is limited!

I look forward to your participation!

Yours, Patrick Nieveler

Read more

11. December 2024 ·

1 Min. Reading time

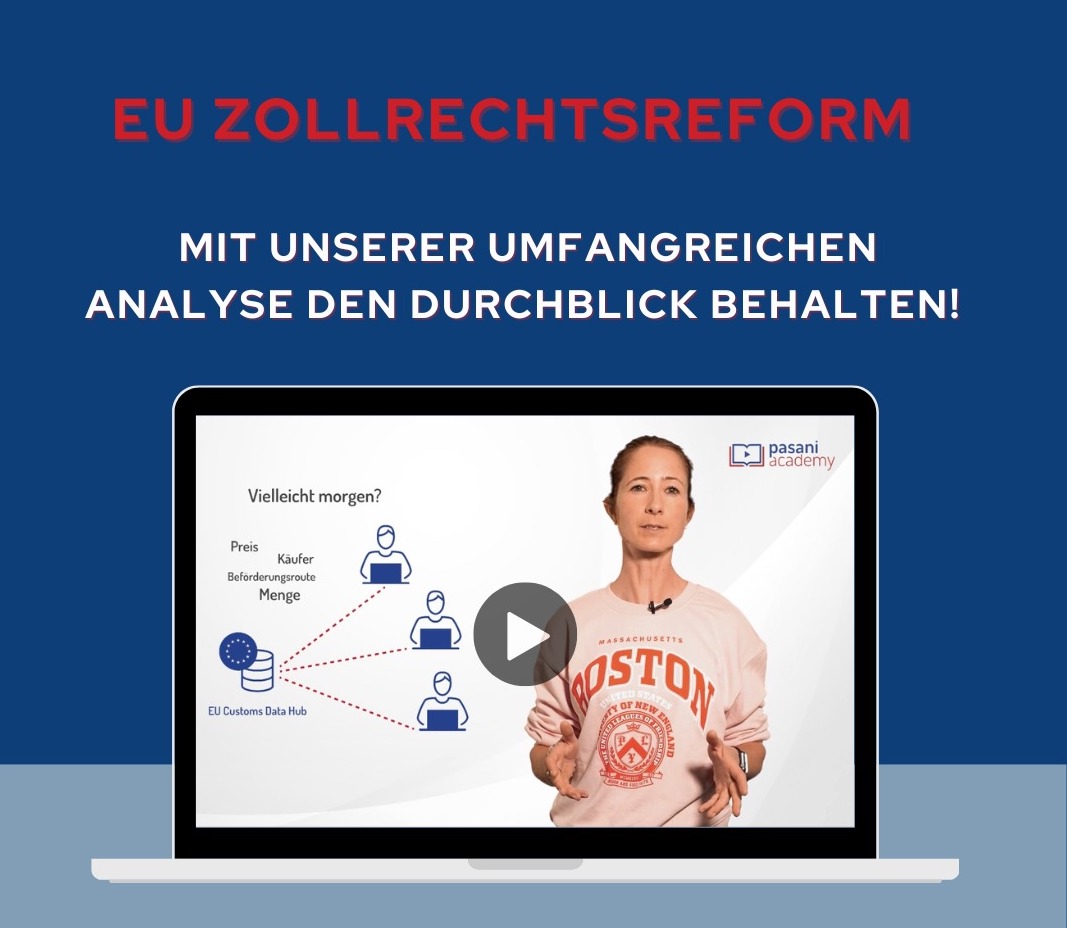

The EU adopts the biggest reform of customs law since 1968!

On 17 May 2023, the EU Commission published the biggest reform of customs law since the founding of the customs union in 1968, which came as a surprise to many!

As announced, our experts Anne Goullon, Stefan Krinner and Dominik Peter have conducted an in-depth analysis of the reform proposals. We have summarised the results for you in four short video contributions that deal with the different areas of the reform.

So, have fun with the videos! I'm already looking forward to your feedback and the professional exchange!

All you need to do is register for free on our learning platform.

https://pasani-academy.knowledgeworker.rocks/?action=registration&voucher=pasani_LI_Zollrechtsreform&design=pasani-academy

Read more

8. December 2024 ·

2 Min. Reading time

Why training and further education are so important in the customs sector ist❗️

"Lifelong learning" - a buzzword of our time. Even though we all realise that this is completely true, it is a phrase that ultimately receives little attention. We often hear phrases like: "We would like to train everyone, but our budget is only enough for a few."

In a recent post, I compared customs to the dentist. Regular training is like dental care - cheaper and less painful than the consequences of neglect.

Many people forget that customs duties are taxes, especially in an international context. Errors in customs clearance can have tax consequences, even prison sentences for tax evasion. ⚖️

Most companies are diligent when it comes to taxes, but customs processes are often neglected. This harbours risks for employees and managers. However, customs errors in the context of legal changes are perceived particularly critically by the authorities. This means that not only basic training but also update training is crucial to avoid mistakes, because:

✅ Only those who have the necessary customs knowledge can act flawlessly.

✅ Customs clearance is a competitive factor; mistakes mean economic, criminal and personal risks and consequences.

✅ If something still goes wrong and this is due to a lack of expertise, this can lead to a "super disaster" on the part of the authorities. However, proof of suitable measures can mitigate this.

✅ Rely on qualified training courses based on real expert knowledge instead of dangerous half-knowledge from the internet.

As an employer and manager, you are concerned about cost-efficient measures that do not disrupt ongoing operations due to employee absence and that are customised to the respective level of knowledge. This is exactly what modern remote concepts offer you: effective, efficient, location-independent and flexible.

To stay with the comparison with the healthcare system: Prevention is ALWAYS better than cure!

Also in the area of customs and tax law. 👍🏼

Your feedback is important to us! We look forward to your comments.

For more informative content, please subscribe to our YouTube channel.

Read more

21. November 2024 ·

2 Min. Reading time

ECJ issues judgement on the retrospective correction of customs declarations!

The European Court of Justice has delivered an important judgement for economic operators in the preliminary ruling on Case C-496/19.

In this case, the claimant imported garden pavilions from China in 2011, some of which were made of iron and some of which were made of aluminium. It declared both variants under tariff heading 6306 1200 00, which provides for an import duty of 12%.

However, after an internal examination, the applicant took the view that the garden pavilions with iron construction should be classified under tariff heading 7308 9099 00, which provides for a duty rate of 0%, and those with aluminium construction should be classified under tariff heading 7610 9099 00, at a duty rate of 6%. Accordingly, the applicant submitted two applications to the competent customs office. One request for a subsequent review of the customs declaration in accordance with Art. 78 CC (Note: old version) and another for a refund of the excess import duties paid. The customs authority rejected these applications.

The plaintiff challenged these decisions before the competent court (Provincial Tax Commission of Salerno, Italy). Before this court of first instance, the customs office justified its decision on the grounds that, firstly, it was not obliged to grant the request for review submitted to it and, secondly, that the tariff item taken into account was correct. With regard to the request for review, it stated that an import of the same type had been the subject of a physical inspection and that this had not been objected to by the customs agent representing the applicant in the main proceedings. The Court of First Instance essentially adopted this reasoning and dismissed the action as unfounded. The plaintiff appealed against this decision.

In the proceedings at second instance, the Court of First Instance referred the following question for a preliminary ruling:

"Does the physical examination of goods carried out in the course of importation preclude the initiation of a procedure for the review of a customs determination under Article 78 of the Customs Code?"

By its question, the court asks whether Article 78 of the Customs Code must be interpreted as precluding a possible review of the customs declaration if the goods in question were subjected to a physical examination during a previous importation without objection, which confirmed their tariff classification.

The European Court of Justice ultimately answered the question referred as follows:

"Article 78 of Council Regulation (EEC) No 2913/92 of 12 October 1992 establishing the Community Customs Code must be interpreted as meaning that it does not preclude the initiation of the procedure for verification of the customs declaration provided for therein, even if the goods in question have undergone a physical check confirming their tariff classification on a previous importation without objection."

The court therefore clarifies that a physical inspection of the goods carried out during importation does not per se preclude the initiation of a procedure to verify the customs declaration in accordance with Art. 78 of the Customs Code.

You can find the full judgement here.

Source:

EUR-LEX

Read more

11. April 2024 ·

2 Min. Reading time

300,000 in customs and criminal tax proceedings: The most expensive break ever! 🫢

And all because of a repair consignment from Switzerland ...

I swear, this story happened exactly like that:

Some time ago, I received a call from a follower who runs a car workshop in southern Germany and specialises in restoring classic cars. A customer from Switzerland had asked if he could restore his classic car. As Switzerland is not part of the EU, he asked me about the procedure in such a case. 🚗

I explained the process of active refinement to him and advised him to find a customs agent at the German-Swiss border who could help with the customs declaration and subsequent re-export. He found this too complicated and decided not to advise the customer and to have the vehicle restored in Switzerland.

A few weeks later, he called me again and told me that his customer had come up with the idea of handing the vehicle over to him on the German side to avoid customs. Unfortunately, he went along with it and the plan was actually realised. 🤦🏼♂️

So the Swiss drove the classic car across the border himself, and the restorer was waiting on the German side with a trailer onto which the vehicle was loaded. So far, so bad. On the way to the workshop, the colleague had to take a toilet break, and at the rest area, of all places, he encountered a mobile customs control unit. The customs officers saw a car with Swiss licence plates on a trailer with German licence plates and carried out a customs check. The scam was discovered.

It was a case of "unlawful introduction", i.e. import smuggling. The officials imposed import duties totalling around €300,000, which had to be paid immediately. The colleague did not want to reveal which vehicle was involved, but with a duty rate of 10% for motor vehicles and 19% import sales tax, the value would be around €1 million. 💰

As the sum could not be paid in cash, the vehicle was confiscated on the spot. According to the garage owner, the Swiss owner paid the sum to get his car back. Both are now facing criminal tax proceedings, as customs duties are taxes and this is no trivial offence.

Two criminal charges richer and €300,000 poorer, the vehicle was not restored and the story ends like this. 🔚

The garage owner asked me if I could help him now. I recommended a good lawyer specialising in criminal tax law. Unfortunately, that was all I could do.

But I can do something for you to avoid such difficulties. With our compact, interactive e-learning courses, you can quickly and easily acquire the expertise you need for correct customs clearance and more. 🧑🏼💻

Have you also had a "curious" experience with customs? Share it with me!

Read more

1. February 2024 ·

2 Min. Reading time

Informal learning in the customs sector – an opportunity for your Unternehmen❗️

Did you know that over 70% of our learning processes take place outside of organised training? That's right, in our daily work environment, in our free time, in dialogue with colleagues and friends. These informal learning processes are often unintentional and spontaneous, but nevertheless extremely valuable. In our latest newsletter, we would like to emphasise the importance of informal learning in the customs sector and show you how you can specifically promote it in your company.

⏺️ This is why informal learning is so important in the customs sector:

Informal learning, as we experience it in the customs sector, refers to the natural acquisition of specialised knowledge during daily work. It happens without previously defined learning objectives or learning objective checks. We all know those situations where a colleague helps us to master a new task or gives us information on legal changes. But in the customs sector in particular, it is crucial to manage informal learning.

⏺️ The risks of uncontrolled informal learning:

Uncontrolled informal learning can lead to risks in the customs sector. Passing on half-knowledge can lead to misinterpretations and incorrect actions. The famous statements "We've always done it this way" or "I took it from colleague xy" are tricky in customs law. Caution: Unknowingly, you may be entering a legal grey area or may already be beyond it.

✅ O ur solution:

Management tutorials on customs law changes. We make sure that your company benefits from the advantages of informal learning without losing control. That's why we've developed management tutorials on customs changes and important updates. These tutorials not only provide you with basic information on current topics, but also a clear structure to deepen your knowledge when needed.

✅ An example:

Our management tutorial on CBAM (Carbon Border Adjustment Mechanism). Even if you are not currently affected, you will receive basic information on this topic. You will be able to assess the relevance for your company. Only when the relevant issue is imminent will you deepen your knowledge and carry out a "DeepDive" if necessary. This type of informal learning, known in learning psychology as "deliberative learning", enables you to react flexibly to the requirements of the customs sector.

👆🏼Fakt is: Informal learning in the customs sector is not only a necessity, but also an opportunity for your company. Our aim is to provide you and your team with the best possible support for the challenges in the customs sector. That is why we are establishing management tutorials as an integral part of our Kursprogramm❗️ programme.

Want to know more? Register now! 📩

If you would like to learn more about this method of informal learning and our management tutorials, we invite you to register via the link below. This will keep you up to date and allow you to benefit from this innovative approach in the field of customs law.

Register here

Read more